Home Equity Lending Solutions

Putting your home equity to work

Your home can be your best ally. That's because the equity in your home can open doors to pay for home improvements, consolidate your debt, pay for student tuition and cover large expenses. Your home’s equity is the difference between the amount your home is worth and the amount you still owe on it. A home equity line of credit (HELOC) allows you to borrow against that available equity.1

More ways to apply or learn more:

How a HELOC works

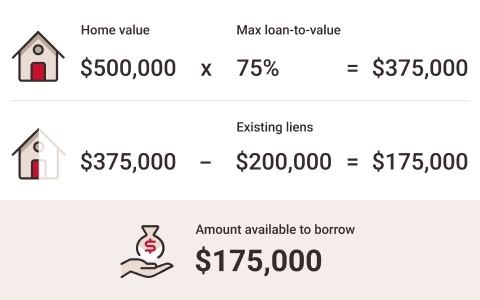

You can potentially borrow1 up to 75% of your home’s value, minus the amount still owed on your home. For example, if your home is appraised at $500,000 and you owe $200,000, then here is how much you can qualify to borrow:

- $500,000 x 75% = $375,000

- $375,00 -$200,000 = $175,000

$175,000 is therefore the maximum home equity line of credit you may borrow from us.

Accessing funds from your HELOC

Accessing funds from your HELOC is easy, but the process varies slightly depending on when you opened your HELOC.

- If you opened your HELOC prior to April 8, 2024, your account number will start with 7. Click HERE for a guide to accessing your funds.

- If you opened your HELOC on or after April 8, 2024, your account number will start with 6. Click HERE for a guide to accessing your funds.

Compare Home Equity Products At-A-Glance

- All products

1 All loans are subject to approval. Programs, rates, terms and conditions are subject to change without notice.

2 The APR is variable and based on the highest Prime Rate published each day in The Wall Street Journal Rates Table (the “index”), plus a margin during the revolving and repayment period. The index plus a margin ranged from 6.75% to 12.25% as of 03/03/2026. In no event will the APR exceed the lesser of 18% or the maximum rate allowed by applicable law. The Margin offered is dependent on the individual’s excellent and substantial credit characteristics. Individuals with less than excellent and substantial credit may be offered a higher margin. Property insurance required including flood insurance where applicable. A processing fee of $180-$500 depending on loan amount is due at closing. Maximum loan to value (LTV) may vary based on applicant(s) credit score. The minimum advance is $4,000. Rates and Terms are subject to change without notice. All loans are subject to credit approval.